After 2022, when a loss wiped out a decade’s worth of profits, Credit Suisse Group AG’s annual bonus pool dropped by 50% to 1 billion francs. Reasons? The share price fell, wealthy clients left, and the bank’s reputation was hurt.

Their hopes for the annual bonus pool currently depend on stock prices increasing by 70%. Ulrich Koerner, the CEO of Credit Suisse, told Bloomberg then that the changes would make the bank more focused and less dangerous. “We will make a lot of money and give it back to shareholders.”

Bloomberg said that Credit Suisse Group AG’s top executive thinks the firm’s investment bank, First Boston, will go public by 2025.

What did Credit Suisse do wrong?

Credit Suisse said in its annual report for 2022, released on March 14 that the bank has found “material weaknesses” in its internal controls over financial reporting and has not yet stopped customers from leaving.

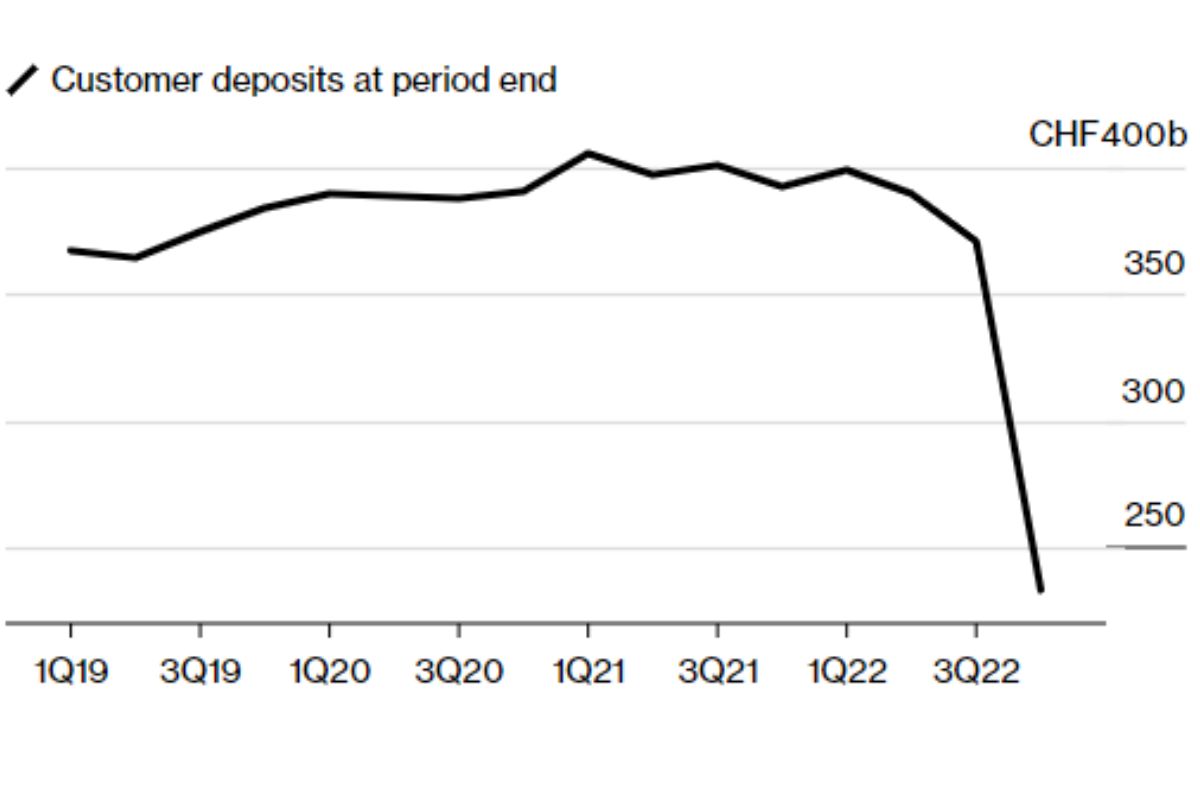

Credit Suisse is trying to get back on its feet after a series of scams that made investors and clients lose faith in the company. Customers took out more than 120 billion Swiss francs in the fourth quarter.

Credit Suisse Deposits Plunged Last Quarter

Bank reported that money withdrawals haven’t stopped in the first months of 2023 after Credit Suisse Deposits Sliding Last Quarter.

How did everything start?

Credit Suisse merged with First Boston in the 1980s and 1990s—Credit Suisse First Boston, which was its investment banking business until 2006.

At the end of 2021, Credit Suisse had over 50,000 workers and more than 1.6 trillion Swiss francs in assets.

Credit Suisse has a Swiss bank in wealth management, business banking, and asset management.

Credit Suisse’s Troubles

In 2019, it was discovered that Pierre-Olivier Bouée, the Chief Operating Officer, had hired private investigators to spy on high-ranking workers. He has fired soon after. The private investigator also suddenly “took his own life,” the bank said when they told people Bouée had been fired.

A month before the Archegos scandal became public, Credit Suisse announced in March 2021 that it was closing and liquidating several client funds worth $10 billion given to Greensill capital, another financial services company. Greensill said it was bankrupt in March 2021.

This is said to have cost investors close to $3 billion.

The Guardian says that in February 2022, a massive leak of information about over 30,000 Credit Suisse clients showed that people who had made money from “torture, drug trafficking, money laundering, corruption, and other serious crimes” held over $100 billion in wealth.

This news hurt the bank’s reputation even more, which made investors even more worried.

Since 2019, several changes have been made at the bank’s top. The most recent change was in July 2022, when the group got a new CEO.

Antonio Horta-Osorio was the group’s head before Axel Lehmann took over in January 2022. Horta-Osorio quit because he broke quarantine rules during the pandemic.

Credit Suisse Deposits Plunged Last Quarter

Ulrich Koerner, the chief executive officer, started a vast outreach to win back uneasy customers and their money. When it announced “net positive” deposits in January, the effort seemed to be paying off. However, the bank was forced to postpone the release of its yearly report after the US Securities and Exchange Commission questioned it on March 9. As a result of the failure of regional US lender Silicon Valley Bank, which was partly caused by risky investments and increasing international interest rates that reduced the value of its bond holdings, panic spread. Investors started to avoid anything that had a banking risk or money flight odor.

Just how awful did things get?

When the chairman of Credit Suisse’s biggest shareholder, Saudi National Bank, disallowed new investments in the business on March 15, that company’s stock fell again. Credit Suisse requested a formal statement of support from the Swiss central bank in response to this. The price to protect the bank’s bonds from default for a year skyrocketed to levels not seen by significant foreign banks since the 2008 financial crisis. The quoted prices for a one-year credit default swap increased from 836 basis points, representing a 10% chance of defaulting, on March 14 to higher than 3,000 basis points as other banks looked to protect themselves against counterparty risk for transactions with Credit Suisse. However, few actual trades were carried out due to decreased market liquidity. Another indication of trouble was that Credit Suisse’s additional tier 1 bonds were trading below 80% of face value, which usually indicates distress. These bonds are subordinate to all other debt ranks and may be written down if capital falls below a certain level. Even bonds with an April maturity date were traded for much less than market value.

What will Credit Suisse do next?

According to Bloomberg News, Credit Suisse and Swiss officials have discussed methods to stabilize the bank. The first shot was fired on March 15 when Switzerland’s central bank and financial regulator announced that the bank would get a liquidity backstop if necessary. Credit Suisse complies with the capital and liquidity standards the regulator sets on systemically important banks, according to the regulator. On March 16, Credit Suisse stated that it had arranged to borrow up to 50 billion francs from the Swiss National Bank. It was launching a tender offer to repurchase up to three billion francs of debt denominated in dollars and euros. According to those who know the situation, alternatives are discussed, including the lender’s Swiss division being split up and a speculative planned merger with giant Swiss rival UBS Group AG. However, it’s unclear whether these actions will be taken. The possibility of the Swiss government purchasing a stake in Credit Suisse as part of a capital raise has also been discussed.

Has the situation gotten worse?

The Bloomberg Commodity Index, which measures prices for 24 raw materials, fell to its lowest level in 14 months on March 15 due to Credit Suisse’s problems, fueling a more comprehensive flight from risky asset classes. Additionally, it’s fueling increasing rumors that central banks will halt their tightening initiatives in the face of the current market turmoil. The main focus is the European Central Bank’s policy meeting on March 16. It will determine whether policymakers will deliver the signaled half-point increase in interest rates or choose a minor move and postpone their efforts to tame surging inflation.

Is this another instance of Lehman Brothers?

When funding dried up, and other banks ceased dealing with the Wall Street giant, whose failure in 2008 ignited the world financial crisis, it succumbed. Credit Suisse is less susceptible to sudden changes in interest rates than many of its competitors, unlike Lehman and SVB, which lack significant liquid assets to draw from and access to central bank loan facilities. Since the worst surge of outflows in October, it has reconstructed its cushion against additional deposit withdrawals. Paul J. Davies, a banking columnist for Bloomberg Opinion, claims it also has enough liquid assets to be converted into money to cover half of its obligations in deposits and loans from other banks. In a time of duress, the company can withstand over a month of significant outflows, according to Koerner’s analysis of the liquidity coverage ratio.

What else is Koerner doing to change the situation?

His three-year recovery plan calls for the elimination of 9,000 jobs, dismantling the investment banking colossus built over five decades, and restoring Credit Suisse to its original position as the banker to the world’s ultra-wealthy. This entails selling portions of its securitized products division to Apollo Global Management Inc. and splitting off First Boston, an American investment bank it bought in 1990, to list it in 2025. Following the failure of SVB and two other US banks, that process risks getting caught up in a broader financial sector selloff.

Will their IPO in 2025 save them?

Ulrich Koerner, the CEO of Credit Suisse, said on Tuesday that the bank wants to make First Boston, an investment bank separate from Credit Suisse, public by 2025.

This is happening as they try to find backers.

The First Boston spinoff is a big part of Koerner’s plan to change how the company works. However, the CEO wants to keep the best interests of the investment bank, like working on mergers and acquisitions, while moving the parent company toward wealth management.

Credit Suisse said earlier today that the top leaders of the new business will get up to 20% of the shares. After an IPO, employees would get limited share units, which would become fully paid three years later and have to be held for a certain amount of time after that.

Read More:

- Installment Loans No Credit Check: What Alternatives and Options Does KashPilot Provide?

- How to Improve Your Chances of Getting a PaydayDaze Bad Credit Loans With Guaranteed Approval

- Credit Card Companies Will Begin Using The Code For Gun Stores

- How Credit Cards May Affect Consumer Behavior