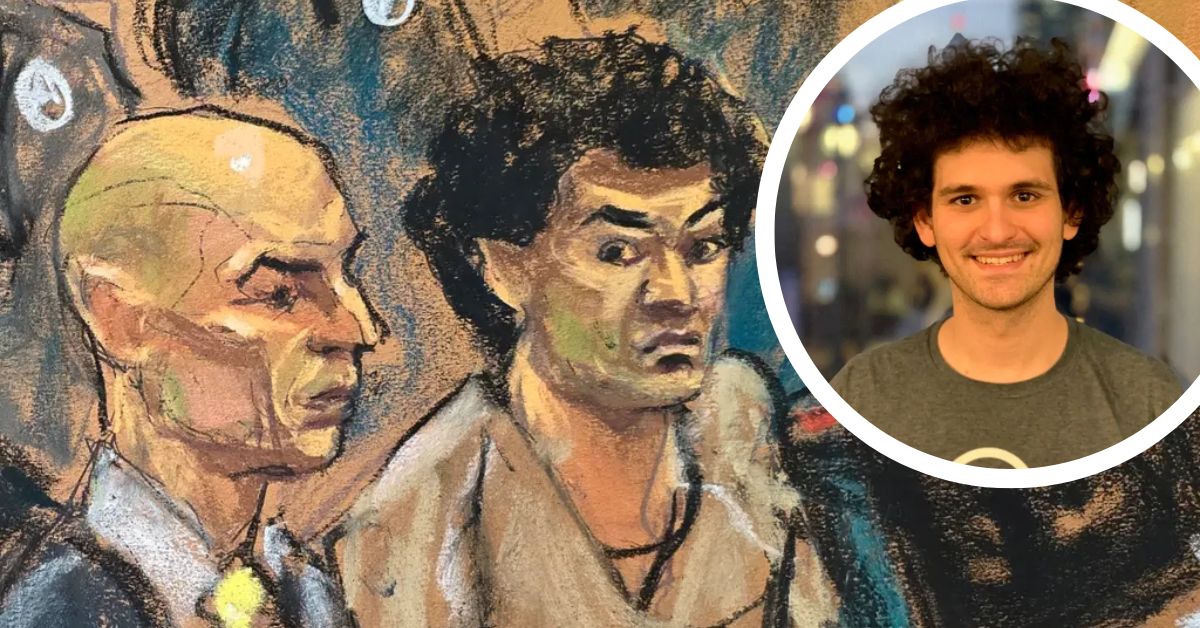

Sam Bankman-Fried, once considered a major player in the world of cryptocurrency and dubbed the “Crypto King,” has been given a hefty prison sentence of 25 years by federal authorities.

This shocking development signals a dramatic downfall for the former CEO of FTX, a cryptocurrency exchange that was once worth a staggering $32 billion. Let’s take a closer look at what led to this high-profile case and how Bankman-Fried’s once-powerful empire came crashing down.

The Rise and Fall of FTX

From Obscurity to Billionaire Status

Sam Bankman-Fried, commonly referred to as SBF, quickly gained fame in the cryptocurrency realm. Before hitting 30, he became a billionaire and transformed FTX, a relatively new company he helped establish in 2019, into the second-largest exchange platform globally.

His charisma attracted attention from celebrities, politicians, and wealthy business leaders, solidifying FTX’s status as a major player in the industry.

The Allegations

Concerns arose regarding the connections between FTX and Bankman-Fried’s other venture, Alameda, leading to scrutiny from the Securities and Exchange Commission (SEC). Additionally, crypto giant Binance initially offered assistance but later withdrew it.

It became evident that there were irregularities in how FTX managed customer funds. This turmoil caused FTX to spiral downward, eventually leading to its bankruptcy filing in November 2022. Shockingly, $8 billion in customer funds were unaccounted for.

Fallen crypto mogul Sam Bankman-Fried sentenced to 25 years in prison | Click on the image to read the full story https://t.co/Y5xlrMAHXi

— WPBF 25 News (@WPBF25News) March 28, 2024

The Trial and Verdict

Conviction on Multiple Counts

In November 2023, a jury found Bankman-Fried guilty of multiple criminal charges, including conspiracy to commit wire fraud, money laundering, commodities fraud, and securities fraud.

Prosecutors claimed that he deceived investors and financial institutions, unlawfully took more than $8 billion from FTX clients, and utilized the money for personal purposes, such as purchasing real estate, making political contributions, and other investments.

Although he insisted on his innocence, the jury swiftly delivered a guilty verdict, indicating a compelling case presented by the prosecution.

The Fallout

Decades Behind Bars

US District Judge Lewis Kaplan imposed a 25-year prison term after dismissing Bankman-Fried’s argument that FTX customers hadn’t suffered losses. The downfall of FTX, previously a dominant force in the crypto world, reverberated throughout the industry.

Bankman-Fried’s rapid ascent and sudden downfall serve as a warning for the crypto community. His reputation will forever be linked with one of the largest financial frauds in US history.

Conclusion

Sam Bankman-Fried’s remarkable journey, transitioning from obscurity to billionaire status and then facing a significant downfall, underscores the risks and repercussions inherent in the volatile realm of cryptocurrencies. As the once-dubbed “Crypto King” embarks on his extended prison sentence, the crypto landscape persists in its evolution, drawing insights from his extraordinary ascent and collapse.

Please note: This article serves solely for informational purposes and does not offer legal counsel.

Read More

- The Man Who Shot Lady Gaga’s Dog Walker Was Sentenced To 21 Years In Prison

- Kris Wu Was Sentenced To 13 Years In Prison By A Chinese Court For Rape