It’s tax filing season, and depending on where you live in the United States, you could be required to hand up a very different-sized portion of your earnings.

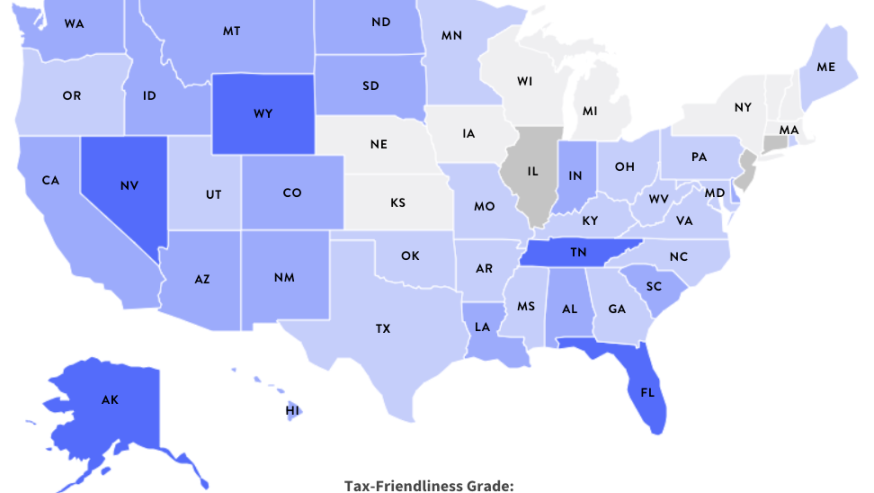

According to a MoneyGeek investigation, every state was graded according to how “tax-friendly” it is. Instead of only looking at income taxes, the analysts considered property taxes, as well as state and municipal sales taxes, among other things.

The MoneyGeek team looked at a hypothetical average household, consisting of a married couple with one child earning the median national salary of $82,852 and owning a $349,400 property, in order to find where people bear the biggest tax burden.

The analysis breaks down the amount of taxes that this imaginary household would have to pay in each state.

California was not among the top 10 states with the greatest or lowest tax burdens, according to the study.

According to the findings of the study, the following states had the lowest tax burden:

- Wyoming (estimated taxes: 4% of income or $3,279)

- Nevada (estimated taxes: 4.7% of income or $3,879)

- Alaska (estimated taxes: 5.4% of income or $4,507)

- Florida (estimated taxes: 5.6% of income or $4,632)

- Tennessee (estimated taxes: 6.5% of income or $5,377)

- Washington (estimated taxes: 6.5% of income or $5,414)

- North Dakota (estimated taxes: 6.7% of income or $5,556)

- Arizona (estimated taxes: 6.8% of income or $5,665)

- South Dakota (estimated taxes: 7.2% of income or $5,938)

- Delaware (estimated taxes: 7.3% of income or $6,074)

The following were the states with the highest tax burden:

- Illinois (estimated taxes: 16.8% of income or $13,894)

- Connecticut (estimated taxes: 15.1% of income or $12,545)

- New Jersey (estimated taxes: 14.3% of income or $11,872)

- New Hampshire (estimated taxes: 14.1% of income or $11,694)

- New York (estimated taxes: 13.9% of income or $11,495)

- Iowa (estimated taxes: 13.8% of income or $11,398)

- Wisconsin (estimated taxes: 13.2% of income or $10,976)

- Vermont (estimated taxes: 12.6% of income or $10,453)

- Nebraska (estimated taxes: 12.6% of income or $10,446)

- Michigan (estimated taxes: 12.4% of income or $10,239)

MoneyGeek also assigned a letter grade to each state based on its “tax friendliness” according to its findings. On average, states with A grades have the lowest tax burden on families, while states with D or E grades have the largest tax burdens on families of all income levels.

According to the report, California scored a “B” grade since its anticipated taxes are 8 percent of income or $6.628 per person.

MoneyGeek’s estimations are valid only for a hypothetical family earning approximately $82,000 per year and owning a $349,000 home, according to the website.

As a result, a family who recently purchased a $1 million home in California would most likely be paying far more in taxes, whereas a single person earning $40,000 in Texas would be paying significantly less.